UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

____________________

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

| | | | | |

| Check the appropriate box: |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under § 240.14a-12 |

PEGASYSTEMS INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | | | | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table belowin exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| (1) | | Title of each class of securities to which transaction applies:

|

| (2) | | Aggregate number of securities to which transaction applies:

|

| (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| (4) | | Proposed maximum aggregate value of transaction:

|

| (5) | | Total fee paid:

|

☐ | Fee paid previously with preliminary materials. |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | | Amount Previously Paid:

|

| (2) | | Form, Schedule or Registration Statement No.:

|

| (3) | | Filing Party:

|

| (4) | | Date Filed:

|

Dear Shareholder:

We cordially invite you to attend our 20212023 Annual Meeting of Shareholders (the “Annual Meeting”) on Tuesday, June 22, 2021.20, 2023 at 1 Main Street, Cambridge, Massachusetts. The Annual Meeting will commence at 10:00 am, Eastern Daylight Time. Due to the continuing impact of COVID-19, this year’s Annual Meeting will be held in a virtual format via a live webcast. You will be able to attend the Annual Meeting, submit questions, and vote during the live webcast by visiting www.meetingcenter.io/242912236 and entering the control number included in your Notice of Internet Availability of Proxy Materials, on your proxy card or voting instruction form, or in the instructions you received via email. Please refer to the additional logistical details and recommendations in the accompanying proxy statement.

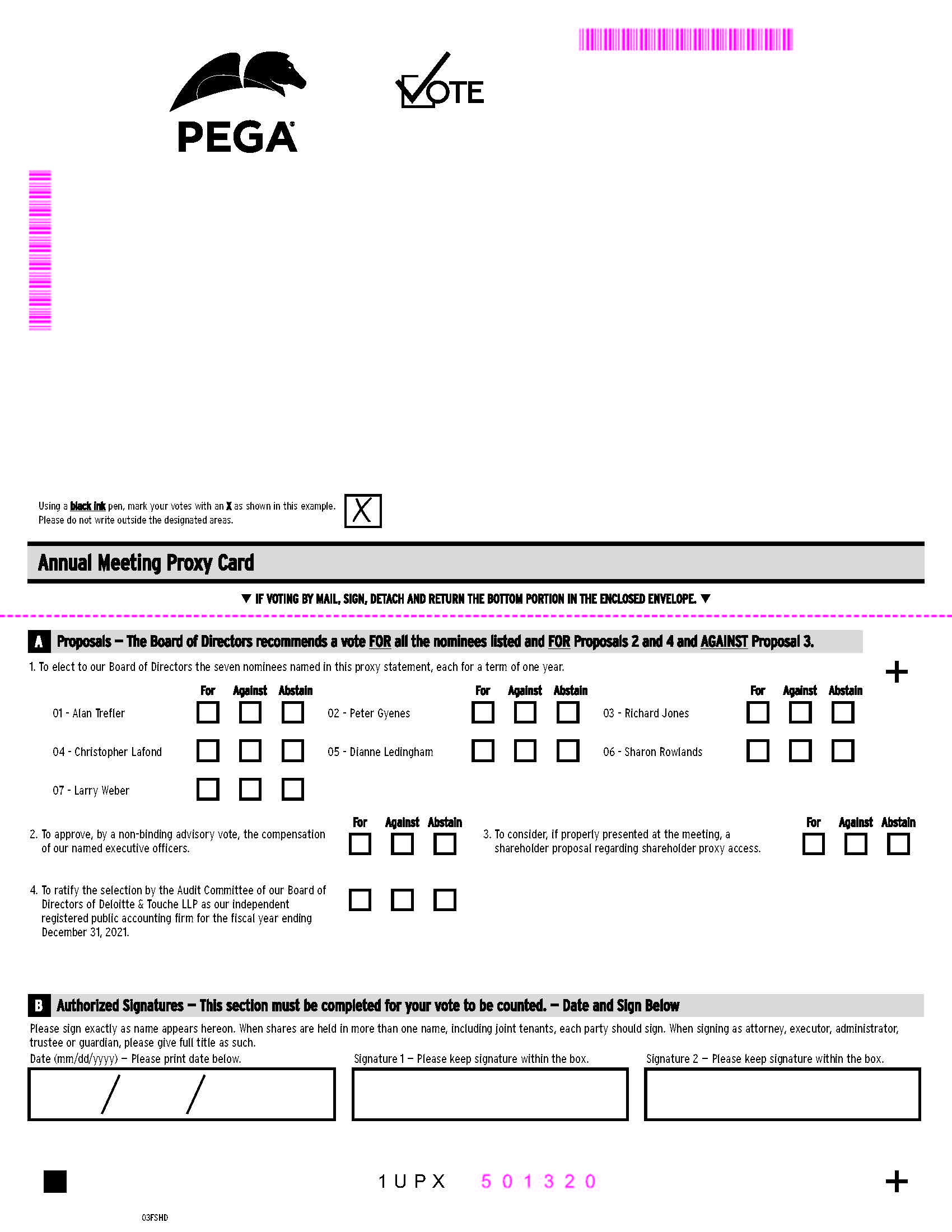

At the Annual Meeting, you are being asked to consider and vote on the following matters: to elect to our Board of Directors the seven nominees named in the proxy statement, each for a term of one year; to approve, by a non-binding advisory vote, the compensation of our named executive officers; to consider, if properly presented atapprove, by a non-binding advisory vote, the meeting, afrequency of the shareholder proposal regarding shareholder proxy access;advisory vote on the compensation of our named executive offers; to approve the amended and restated Pegasystems Inc. 2004 Long-Term Incentive Plan; to approve the amended and restated Pegasystems Inc. 2006 Employee Stock Purchase Plan; and to ratify the selection by the Audit Committee of our Board of Directors of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021.2023.

Please vote your shares by submitting your proxy in the manner described in the proxy statement so that your shares can be voted at the Annual Meeting in accordance with your instructions. Even if you plan to attend the Annual Meeting, we urge you to vote your shares prior to the meeting. You can revoke your proxy at any time before the Annual Meeting or vote your shares during the Annual Meeting by following the procedures described in the accompanying proxy statement.

We thank you for your continued support of Pega.

Sincerely,

| | |

| Alan Trefler |

| Chairman and Chief Executive Officer |

May 7, 20218, 2023 |

PEGASYSTEMS INC.

One Rogers1 Main Street

Cambridge, MA 02142

NOTICE OF 20212023 ANNUAL MEETING OF SHAREHOLDERS

To be held on June 22, 202120, 2023

To our Shareholders:

The 20212023 Annual Meeting of Shareholders of Pegasystems Inc. will be held at 1 Main Street, Cambridge, Massachusetts, on Tuesday, June 22, 202120, 2023 beginning at 10:00 am, Eastern Daylight Time. Due to the continuing impact of COVID-19, this year’s Annual Meeting will be held in a virtual format via a live webcast. You will be able to attend the Annual Meeting, submit questions and vote during the live webcast by visiting www.meetingcenter.io/242912236 and entering the control number included in your Notice of Internet Availability of Proxy Materials, on your proxy card or voting instruction form, or in the instructions you received via email.

At the meeting, shareholders will consider and vote on the following matters:

1.To elect to our Board of Directors the seven nominees named in the proxy statement, each for a one-year term.

2.To approve, by a non-binding advisory vote, the compensation of our named executive officers.

3.To consider, if properly presented atapprove, by a non-binding advisory vote, the meeting, afrequency of the shareholder proposal regarding shareholder proxy access.advisory vote on the compensation of our named executive officers.

4.To approve the amended and restated Pegasystems Inc. 2004 Long-Term Incentive Plan.

5.To approve the amended and restated Pegasystems Inc. 2006 Employee Stock Purchase Plan.

6.To ratify the selection by the Audit Committee of our Board of Directors of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021.2023.

Shareholders of record at the close of business on April 21, 202120, 2023 are entitled to vote at the meeting. Whether you plan to attend the meeting or not, please vote your shares by submitting your proxy over the Internet, or by telephone, or by completing, signing, dating, and returning a proxy card, each in the manner described in the proxy statement. For specific instructions on how to vote your shares, please refer to the “Information About the Annual Meeting and Voting” section of the attached proxy statement. Your prompt response is requested to ensure your shares are represented at the meeting. You can revoke your proxy and change your vote at any time before the polls close at the meeting by following the procedures described in the accompanying proxy statement. By Order of the Board of Directors,

| | |

| Matthew J. Cushing |

Vice President, Chief Commercial Officer, General Counsel, and Secretary |

| Cambridge, Massachusetts |

May 7, 20218, 2023 |

TABLE OF CONTENTS

PEGASYSTEMS INC.

One Rogers1 Main Street

Cambridge, MA 02142

PROXY SUMMARY

20212023 Annual Meeting of Shareholders

•Date/Time: Tuesday, June 22, 2021,20, 2023, 10:00 am. Eastern Daylight Time

•Place: Virtual Meeting Site www.meetingcenter.io/242912236Pegasystems Inc., 1 Main Street, Cambridge, MA 02142

•Record Date: April 21, 202120, 2023

•Date Proxy Materials First Provided to Shareholders: on or about May 7, 2021.8, 2023

Proposals and Board Recommendations

| | | | | | | | | | | |

| Board Vote Recommendation | | Page Number |

Proposal 1: To elect to our Board of Directors the seven nominees named in this proxy statement, each for a term of one year. | FOR each director nominee | | |

Proposal 2: To approve, by a non-binding advisory vote, the compensation of our named executive officers. | FOR | | |

Proposal 3: To consider, if properly presented atapprove, by a non-binding advisory vote, the meeting, afrequency of the shareholder proposal regarding shareholder proxy access.advisory vote on the compensation for our named executive officers. | AGAINSTFOR annual frequency | | |

Proposal 4: To approve the amended and restated Pegasystems Inc. 2004 Long-Term Incentive Plan. | FOR | | |

Proposal 5: To approve the amended and restated Pegasystems Inc. 2006 Employee Stock Purchase Plan. | FOR | | |

Proposal 6: To ratify the selection by the Audit Committee of our Board of Directors of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021.2023. | FOR | | |

COMPENSATION DISCUSSION AND ANALYSIS HIGHLIGHTS

Our executive compensation is designed to reward performance by our executives and to align the interests of our executives with our shareholders.

For 2020,2022, our executive compensation program included the following elements of fixed and variable compensation:

| | | | | | | | | | | | | | |

| Element | | Objective | | Fixed/Variable |

| Base Salary | | Attract and retain highly qualified leaders with market-competitive compensation structure. | | Fixed |

| Bonus (Corporate Incentive Compensation Plan or CICP) | | Link pay with our performance. Reward achievement of our financial and strategic goals. | | Variable |

| Additional Cash Incentives | | Link pay with individual, business unit and/or corporate performance. Reward achievement of specific goals. | | Variable |

| Equity Awards (Stock Options and Restricted Stock Units) | | Link pay with our long-term performance. Reward stock price appreciation, promote long-term retention and permit executives to accumulate equity ownership in the Company. | | Variable |

| Other Perquisites | | Retain talent by providing financial protection and security. | | Fixed |

20202022 FINANCIAL HIGHLIGHTS

The financial highlights information contained in this proxy statement describes the results achieved by Pegasystems Inc. for its shareholders in 2020.2022. As it is a summary, it does not contain all the information you should consider. Therefore, before voting, we encourage you to read this proxy statement in its entirety and our Annual Report on Form 10-K for the fiscal year ended December 31, 2020,2022, including the sections captioned “Financial Statements and Supplementary Data”, “Risk Factors”, and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”.

We develop, market, license, host, and support enterprise software applications that helphelps organizations simplifybuild agility into their business complexity.so they can adapt to change. Our intelligent technologypowerful low-code platform for workflow automation and scalable architectureartificial intelligence-powered decisioning enables the world’s leading brands and government agencies to solve problems quicklyhyper-personalize customer experiences, streamline customer service, and transform for tomorrow. Our clients are able to make better decisionsautomate mission-critical business processes and get work done using real-time artificial intelligence (“AI”) and intelligent automation on applications built on the low-code, cloud-nativeworkflows. With Pega, Platform™, enabling our clients can leverage our intelligent technology and scalable architecture to streamline service, increase customer lifetime value, and boost efficiency. Our consulting andaccelerate their digital transformation. In addition, our client success teams, along with our world-class partners, and clients leverage our Pega Express™ methodology and low code to allow clients to design and deploy criticalmission-critical applications quickly and collaboratively.

Cloud TransitionOur target clients are Global 2000 organizations and government agencies that require solutions to distinguish themselves in the markets they serve. Our solutions achieve and facilitate differentiation by increasing business agility, driving growth, improving productivity, attracting and retaining customers, and reducing risk. Along with our partners, we deliver solutions tailored to the specific industry needs of our clients.

Subscription transition

We are in the process of transitioning our business to sell software primarily through subscription arrangements, particularly Pega Cloud (“Cloud Transition”).arrangements. Until we substantiallyfully complete our Cloud Transition,subscription transition, which we anticipateexpect will occur in early 2023, we expect to continue to experience lowerour operating results may be impacted. Operating performance, revenue growth and lower operating cash flow growth or negative cash flow. The actual mix, of revenue and new arrangements in a giveneach period can fluctuate based on client preferences.

Coronavirus (“COVID-19”)

As of April 29, 2021, COVID-19 has not had a material impact onpreferences for our results of operations or financial condition.

COVID-19’s ultimate impact on our operationalperpetual and financial performance will depend on future developments, including the duration and spread of the outbreak and the impact of COVID-19 on our sales cycles, partners, vendors, and employees, all of which is uncertain and unpredictable. Our shift towards subscription-based revenue streams, the industry mix of our clients, the substantial size and available resources of our clients, and the critical nature of our products to our clients may reduce or delay the impact of COVID-19 on our business. However, it is not possible to estimate the ultimate impact that COVID-19 will have on our business at this time.

Relocation of Corporate Headquarters

On February 12, 2021, we entered into an agreement with our landlord to vacate our Cambridge, Massachusetts corporate headquarters on October 1, 2021, in exchange for a one-time payment to us of $18 million. We expect to enter into a new lease agreement for a facility within the greater Boston area.subscription offerings.

Performance metrics

We utilize severaluse performance metrics to analyze and assess our overall performance, make operating decisions, and forecast and plan for future periods, including:

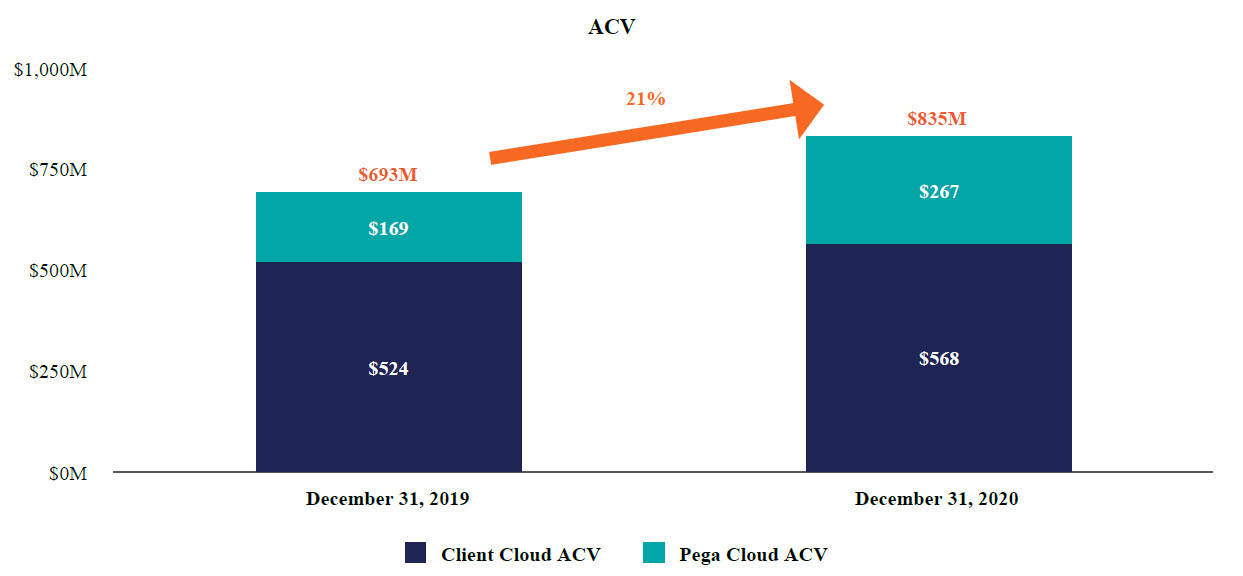

Annual contract value (“ACV”) | Increased 21% since December 31, 2019

•ACV as reported, represents the annualized value of our active contracts as of the measurement date. The contract’scontract's total value is divided by its duration in years to calculate ACV for termsubscription license and Pega Cloud contracts. Maintenance revenue for the quarter then ended is multiplied by four to calculate ACV for maintenance. Client Cloud ACV is composed of maintenance ACV and ACV from term license contracts. ACV is a performance measure that we believe provides useful information to our management and investors, particularly during our Cloud Transition. Reported amounts have not been adjusted for changes in foreign exchange rates. Foreign currency contributed 1%-2% to ACV growth in 2020.subscription transition.

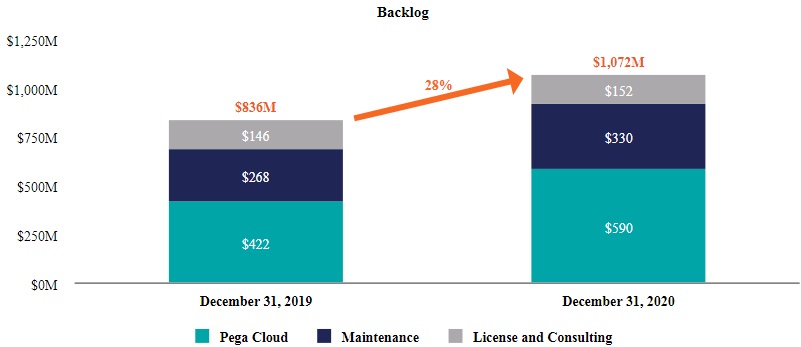

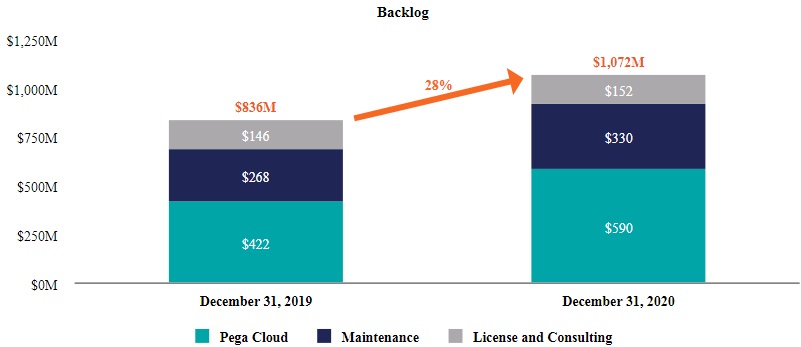

Remaining performance obligations (“Backlog”) | Increased 28% since December 31, 2019

•Reconciliation of GAAP Backlog represents contracted revenueand Constant Currency Backlog

| | | | | | | | | | | |

| (in millions, except percentages) | Q4 2022 | | 1 Year Growth Rate |

| Backlog | $ | 1,356 | | | 1 | % |

| Impact of changes in foreign exchange rates | 39 | | | 3 | % |

| Backlog - Constant Currency | $ | 1,395 | | | 4 | % |

Note: Constant currency measures are calculated by applying foreign exchange rates for the earliest period shown to all periods. The above constant currency measures reflect foreign exchange rates applicable as of Q4 2021. We believe that hasnon-GAAP financial measures help investors understand our core operating results and prospects, consistent with how management measures and forecasts our performance without the effect of often one-time charges and other items outside our normal operations. The supplementary non-GAAP financial measures are not yet been recognized and includes deferred revenue and non-cancellable amounts expectedmeant to be invoiced and recognized as revenue in future periods.

•

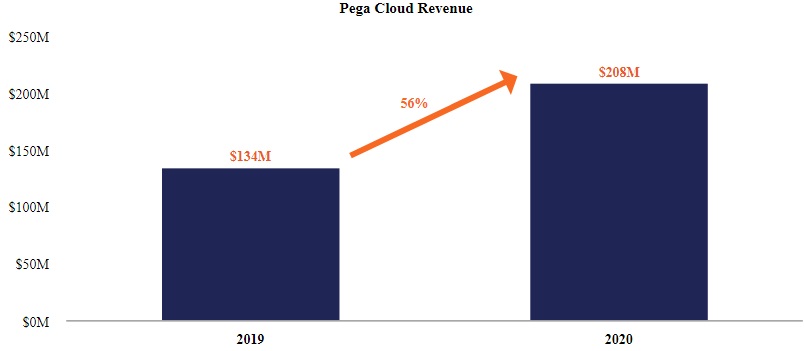

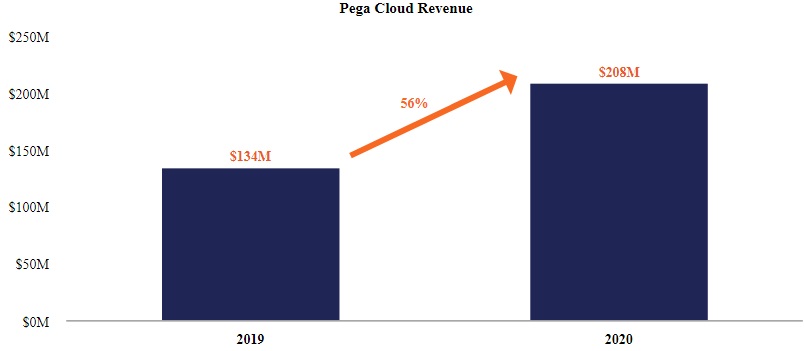

Pega Cloud revenue | Increased 56% since 2019

•Pega Cloud revenue is revenue as reportedsuperior to or a substitute for financial measures prepared under U.S. GAAP for cloud contracts.GAAP.

| | | | | | | | | | | | | | | | | |

| (in thousands, except percentages) | Year Ended

December 31, |

| 2022 | | 2021 | | Change |

| Cash provided by operating activities | $ | 22,336 | | | $ | 39,118 | | | (43) | % |

| Investment in property and equipment | (35,379) | | | (10,456) | | | |

| Legal fees | 41,789 | | | 11,390 | | | |

| | | | | |

| Interest on convertible senior notes | 4,500 | | | 4,500 | | | |

| Facilities | — | | | (18,000) | | | |

| Other | 6,805 | | | 115 | | | |

| Free cash flow | $ | 40,051 | | | $ | 26,667 | | | 50 | % |

| | | | | |

| Total Revenue | $ | 1,317,845 | | | $ | 1,211,653 | | | |

| Free cash flow margin | 3 | % | | 2 | % | | |

(1) Our non-GAAP free cash flow measures reflect the following adjustments:

•Investment in property and equipment: Investment in property and equipment fluctuates in amount and frequency and is significantly affected by the timing and size of investments in our facilities. We believe excluding these amounts provides a useful comparison of our operational performance in different periods.

•Legal Fees: Includes legal and related fees arising from proceedings outside of the ordinary course of business. We believe excluding these expenses from our non-GAAP financial measures is useful to investors as the disputes giving rise to them are not representative of our core business operations and ongoing operating performance.

•Interest on convertible senior notes: In February 2020, we issued convertible senior notes with an aggregate principal amount of $600 million, due March 1, 2025, in a private placement. We believe excluding the interest payments provides a useful comparison of our operational performance in different periods.

•Facilities: In February 2021, we agreed to accelerate our exit from our then Cambridge, Massachusetts headquarters to October 1, 2021, in exchange for a one-time payment from our landlord of $18 million, which was received in October 2021. We believe excluding the impact from our non-GAAP financial measures is useful to investors as the modified lease, including the $18 million payment, is not representative of our core business operations and ongoing operating performance.

•Other: We have excluded capital advisory fees and fees incurred due to the cancellation of in-person sales and marketing events. We believe excluding these amounts from our non-GAAP financial measures is useful to investors as the types of events giving rise to them are not representative of our core business operations and ongoing operating performance.

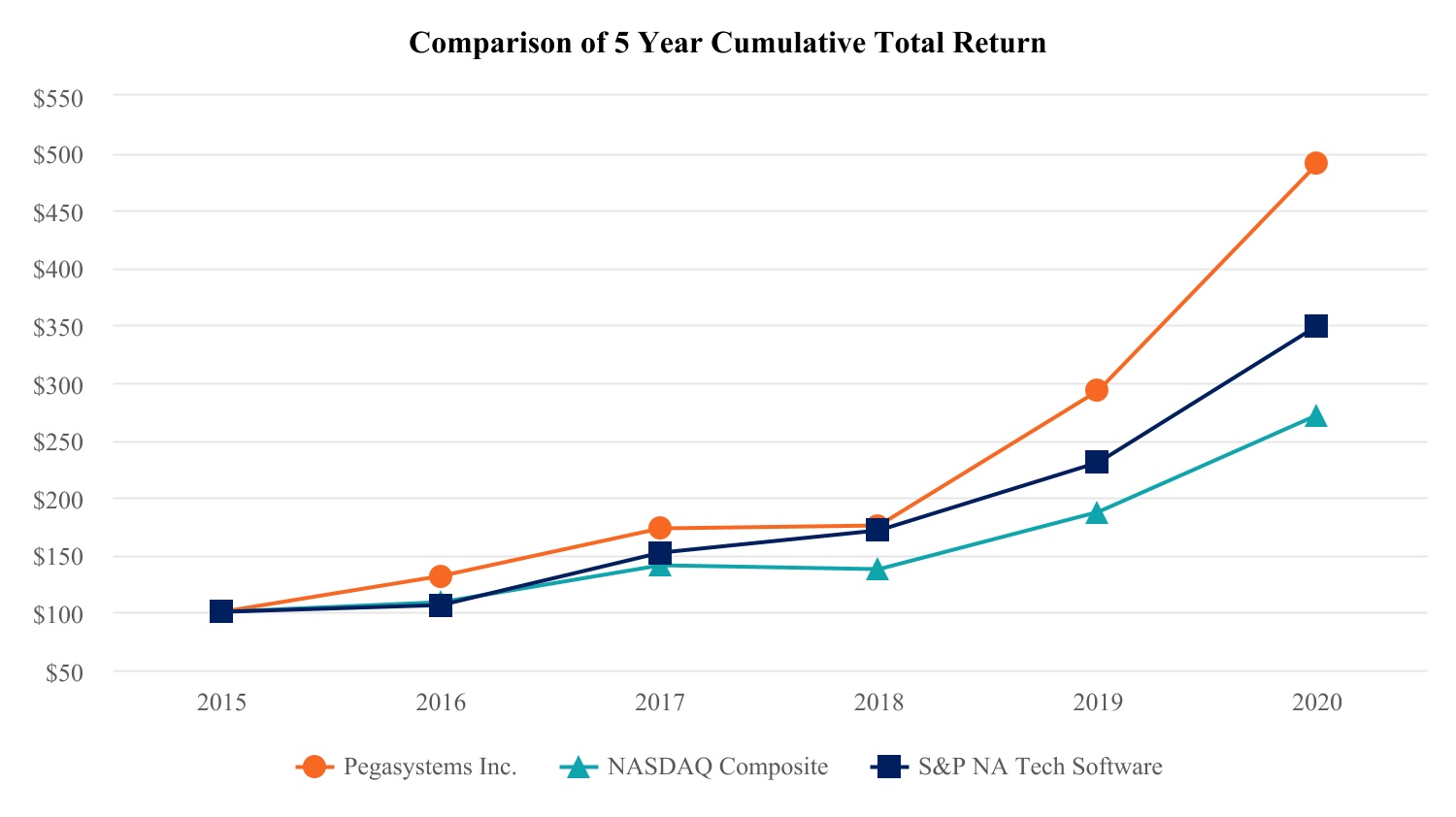

Stock performance graph and cumulative total shareholder return

•The following performance graph represents a comparison of the cumulative total shareholderstockholder return, assuming the reinvestment of dividends, for a $100 investment on December 31, 20152017 in our common stock, the Total Return Index for the NASDAQ Composite, a broad market index, and the Standard & Poor’s (“S&P”) North American Technology Sector - Software Index™ (“S&P NA Tech Software”), a published industry index.

PEGASYSTEMS INC.

One Rogers1 Main Street

Cambridge, MA 02142

PROXY STATEMENT FOR ANNUAL MEETING OF SHAREHOLDERS

To be held on June 22, 202120, 2023

This proxy statement contains information about the 20212023 Annual Meeting of Shareholders of Pegasystems Inc. The Annual Meeting will be held on Tuesday, June 22, 2021,20, 2023, beginning at 10:00 am, Eastern Daylight Time. Due to the continuing impact of COVID-19, this year’s Annual Meeting will be held in a virtual format via a live webcast. You will be able to attend the Annual Meeting, submit questions and vote during the live webcast by visiting www.meetingcenter.io/242912236.Time at 1 Main Street, Cambridge, MA 02142. Unless the context otherwise requires, references in this proxy statement to “Pegasystems,” the “Company,” “we,” “us,” or “our” refer to Pegasystems Inc.

This proxy statement is furnished in connection with the solicitation of proxies by our Board of Directors for use at the Annual Meeting and at any adjournment of that meeting. All proxies will be voted in accordance with the instructions they contain. If you do not specify your voting instructions on the proxy you submit for the meeting, it will be voted in accordance with the recommendation of the Board of Directors. If you are the record holder of your shares, you may revoke your proxy and change your vote at any time before it is exercised at the meeting by giving our Secretary written notice to that effect or a duly executed proxy bearing a later date or by voting your shares online at the Annual Meeting. Any shareholder owning shares in “street name” may revoke a proxy or change previously given voting instructions by contacting the bank or brokerage firm holding the shares. We first provided access to our proxy materials over the Internet at www.envisionreports.com/PEGA on or about May 7, 2021.8, 2023.

Pursuant to Rule 14a-16 under the Securities Exchange Act of 1934, as amended, or the Exchange Act, our Annual Report on Form 10-K for the fiscal year ended December 31, 2020,2022, or Annual Report, as filed with the Securities and Exchange Commission, or SEC, is being made available to shareholders on our website, www.pega.com, and at the following URL: www.envisionreports.com/PEGA.

You may obtain a copy of our Annual Report without charge upon written request to:

Pegasystems Inc.

One Rogers

1 Main Street

Cambridge, MA 02142-1209

02142-1517

Attention: Secretary

The Annual Report does not constitute any part of this proxy statement. Certain documents referenced in this proxy statement are available on our website at www.pega.com. Information contained on our website is not included as part of, nor incorporated by reference into, this proxy statement.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be held on June 22, 2021.20, 2023.

This proxy statement and our Annual Report are available for viewing, printing, and downloading at

www.envisionreports.com/PEGA.

INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

What is the purpose of the Annual Meeting?

At the Annual Meeting, shareholders will consider and vote on the following matters:

1.To elect to our Board of Directors the seven nominees named in this proxy statement, each for a one-year term.

2.To approve, by a non-binding advisory vote, the compensation of our named executive officers, also referred to as Say on Pay, as described in the “Compensation Discussion and Analysis” section and elsewhere in this proxy statement. 3.To consider, if properly presented atapprove, by a non-binding advisory vote, the meeting, afrequency of the shareholder proposal regarding shareholder proxy access.advisory vote on the compensation of our named executive officers.

4.To approve the amended and restated Pegasystems Inc. 2004 Long-Term Incentive Plan (the “Plan”).

5.To approve the amended and restated Pegasystems Inc. 2006 Employee Stock Purchase Plan (the “ESPP”).

6.To ratify the selection by the Audit Committee of our Board of Directors of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021.2023.

How does the Board of Directors recommend that I vote on the Proposals?

The Board of Directors recommends that you vote:

•FOR the election to our Board of Directors of each of the seven nominees named in this proxy statement, each to hold office for a term of one year (Proposal 1);

•FOR the approval, by a non-binding advisory vote, of the compensation of our named executive officers, also referred to as Say on Pay, as described in the “Compensation Discussion and Analysis” section and elsewhere in this proxy statement (Proposal 2); •AGAINSTFOR the shareholder proposal regarding shareholder proxy accessapproval, by a non-binding advisory vote, of holding the non-binding advisory vote on the compensation of our named executive officers every year (Proposal 3);

•FOR the approval of the Plan (Proposal 4);

•FOR the approval of the ESPP (Proposal 5); and

•FOR the ratification of the selection by the Audit Committee of our Board of Directors of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 20212023 (Proposal 4)6).

Who can vote?

To be able to vote, you must have been a Pegasystems shareholder of record at the close of business on April 21, 2021.20, 2023. This date is the Record Date for the Annual Meeting. On the Record Date, there were 81,267,18382,961,218 shares of our common stock outstanding and entitled to vote.

How many votes do I have?

Each share of our common stock that you owned on the Record Date entitles you to one vote on each matter before the shareholders at the Annual Meeting.

Is my vote important?

Your vote is important regardless of how many shares you own. Please take the time to vote. Also, please take a moment to read the instructions below.

Why did I receive a notice in the mail regarding the Internet availability of proxy materials this year instead of a full set of proxy materials?

We are pleased to comply with the SEC rules that direct companies to distribute their proxy materials over the Internet, as we have done in past years. As a result, we have sent our shareholders and beneficial owners a Notice of Internet Availability of Proxy Materials, or the Availability Notice, instead of paper copies of this proxy statement, our proxy card, and our Annual Report. Detailed instructions on how to access these materials over the Internet may be found in the Availability Notice. This proxy statement and our Annual Report are available for viewing, printing, and downloading at www.envisionreports.com/PEGA.

I prefer to read my proxy materials on paper. How do I get paper copies?

The Availability Notice contains instructions on how to request paper copies by phone, email, or the Internet. You will be sent the materials by first class mail within three business days of your request, at no cost to you. If you receive your proxy materials by mail, you may vote your shares by completing, signing, and dating the proxy card that accompanies this proxy statement and promptly mailing it in the enclosed postage-prepaid envelope. Once you request paper copies, you will continue to receive the materials in paper form until you instruct us otherwise. Please note, however, that the online proxy materials will also be in a format suitable for printing on your own printer.

How can I vote?

If you are the “record holder” of your shares, meaning that you own your shares in your own name and not through a bank or brokerage firm, you may vote over the Internet or by telephone or mail, or you may vote online duringin person at the Annual Meeting by visiting www.meetingcenter.io/242912236 and entering the 15-digit control number found in your Availability Notice, on your proxy card or voting instruction form, or in the instructions you received via email, and following the on-screen instructions.Meeting. If your shares are held in “street name” by a bank or brokerage firm, please see the first sentence of the “Can I vote if my shares are held in ‘street name’?” section below for instructions regarding how to vote your shares.

Voting by Internet. You may vote your proxy over the Internet by following the instructions provided in the Availability Notice and on the proxy card.

Voting by telephone. You may vote your proxy over the telephone by following the instructions provided in the Availability Notice and on the proxy card.

Voting by mail. You may vote your proxy by printing, completing, signing, and dating the proxy card that accompanies this proxy statement and promptly mailing it in accordance with the instructions provided on the proxy card. The shares you own will be voted according to the instructions on the proxy card you submit. If you return the proxy card but do not give any instructions on a particular matter described in this proxy statement, the shares you own will be voted in accordance with the recommendations of our Board of Directors. The Board of Directors recommends that you vote FOR the director nominees, and FOR Proposals 2, 4, 5 and 4. The Board6, and, on Proposal 3, FOR an annual vote on the compensation of Directors recommends that you vote AGAINST Proposal 3.our named executive officers.

Voting in person at the Annual Meeting. You may vote online duringIf you attend the Annual Meeting, you may vote by visiting www.meetingcenter.io/242912236 and enteringdelivering your completed proxy in person or by completing a ballot. Ballots will be available at the control number included in your Availability Notice, on your proxy card or voting instruction form, or in the instructions you received via email, and following the on-screen instructions.Annual Meeting.

Can I vote my shares by filling out and returning the Availability Notice?

No. The Availability Notice contains instructions on how to vote over the Internet, by telephone, by requesting and returning a paper proxy card, or by voting online during the Annual Meeting.

Can I vote if my shares are held in “street name”?

If the shares you own are held in “street name” by a bank or brokerage firm, your bank or brokerage firm, as the record holder of your shares, is required to vote your shares according to your instructions. To vote your shares, you will need to follow the directions your bank or brokerage firm provides you. Many banks and brokerage firms also offer the option of voting over the Internet or by telephone, instructions for which would be provided by your bank or brokerage firm on your voting instruction form.

Under the applicable rules of the NASDAQ Global Select Market, or Nasdaq, if you do not give instructions to your bank or brokerage firm, it will still be able to vote your shares with respect to certain “discretionary” items, but it will not be allowed to vote your shares with respect to certain “non-discretionary” items. The ratification of Deloitte & Touche LLP as our independent registered public accounting firm (Proposal 4)6) is considered to be a “discretionary” item under Nasdaq rules, and your bank or brokerage firm will be able to vote on this item even if it does not receive instructions from you, so long as it holds your shares in its name. The election of directors (Proposal 1), the advisory vote on executive compensation (Proposal 2), andthe advisory vote on the frequency of the shareholder proposal regarding shareholder proxy accessadvisory vote on the compensation of our named executive officers (Proposal 3), the approval of the Plan (Proposal 4),andthe approval of the ESPP (Proposal 5)are “non-discretionary” items. If you do not instruct your broker how to vote with respect to these items, your broker is not permitted to vote with respect to these proposals, and those votes will be counted as “broker non-votes.” “Broker non-votes” are shares that are held in “street name” by a bank or brokerage firm that indicates on its proxy that it does not have or did not exercise discretionary authority to vote on a particular matter.

Can I change my vote after I have submitted my proxy?

Yes. If your shares are registered in your name, you can revoke your proxy and change your vote at any time before the polls close for the Annual Meeting by doing any one of the following things:

•signing another proxy with a later date;

•giving our Secretary a written notice before or at the Annual Meeting that you want to revoke your proxy;

•voting over the Internet or by telephone by following the instructions provided in the Availability Notice and on the proxy card by 1:00 a.m., Eastern Daylight Time, on June 22, 2021;20, 2023; or

•voting duringin person at the Annual Meeting by visiting www.meetingcenter.io/242912236 and entering the control number included in your Availability Notice, on your proxy card or voting instruction form, or in the instructions you received via email.Meeting.

Your attendance at the Annual Meeting alone, without also voting, will not revoke your proxy.

If your shares are held in “street name” and you wish to revoke a proxy, you should contact your bank or brokerage firm and follow its procedures for changing your voting instructions.

What constitutes a quorum?

In order for business to be conducted at the Annual Meeting with respect to a particular matter, a quorum must be present in person or represented by valid proxies for that particular matter. For each of the proposals described in this proxy statement, a quorum consists of the holders of a majority of the shares of common stock issued and outstanding on April 21, 2021,20, 2023, the Record Date, which is approximately 40,633,59241,480,610 shares of our common stock.

Shares of common stock represented in person or by proxy, including “broker non-votes” and shares that abstain or do not vote with respect to one or more of the matters to be voted upon, will be counted for the purpose of determining whether a quorum exists. A share once represented for any purpose at the Annual Meeting is deemed present for quorum purposes for the remainder of the meeting and for any adjournment of the meeting unless (1) the shareholder attends solely to object to lack of notice, defective notice, or the conduct of the meeting on other grounds and does not vote the shares or otherwise consent that they are to be deemed present, or (2) in the case of an adjournment, a new Record Date is set for that adjourned meeting.

If a quorum is not present, the meeting will be adjourned until a quorum is obtained.

What vote is required for each item?

Proposal 1: Election of Directors. Under our Amended and Restated Bylaws, with respect to each of the seven nominees for director, the number of votes cast at the Annual Meeting in favor of such nominee must represent a majority of the votes entitled to be cast in an election of directors by all issued and outstanding shares of common stock on the Record Date. This means that if any nominee is one of the seven nominees receiving the highest number of votes cast at the Annual Meeting, but the number of votes cast for such nominee does not represent a majority of the votes entitled to be cast in an election of directors by all issued and outstanding shares, such nominee will not be elected as a director. If your shares are held in “street name” and you do not instruct your broker how to vote with respect to this item, your broker is not permitted to vote your shares with respect to this proposal.

Proposal 2: Advisory Vote on Executive Compensation. Our Board of Directors is seeking a non-binding advisory vote to approve the compensation of our named executive officers. Under our Amended and Restated Bylaws, approval for such non-binding resolution requires that the votes cast in favor exceed the votes cast in opposition. While this vote is non-binding and advisory in nature, our Board of Directors and Compensation Committee will consider the outcome of the vote when determining executive compensation arrangements. If your shares are held in “street name” and you do not instruct your broker how to vote with respect to this item, your broker is not permitted to vote your shares with respect to this proposal.

Proposal 3: Shareholder Proposal Regarding Shareholder Proxy Access. A shareholder requests thatAdvisory Vote on the shareholdersFrequency of the Company adviseShareholder Advisory Vote on Executive Compensation. Our Board of Directors is seeking a non-binding advisory vote regarding the Board to take the necessary steps so that nominating shareholders, individually or in the aggregate, that have owned at least 3%frequency of the outstanding sharesadvisory vote on the compensation of common stockour named executive officers. Under Section 1A of the Securities Exchange Act, the Company continuously for a period of at least 3-years be entitledmust hold an advisory vote every six years to nominate a total of up to 25% ofdetermine if the number of authorized directors. Under our Amended and Restated Bylaws, the advisory proposal would be passed with the approval of a majority of the shares entitled to be cast. “Say on Pay” votes should occur every one, two, or three years. If your shares are held in “street name” and you do not instruct your broker how to vote with respect to this item, your broker ismay not permitted to vote your shares with respect to this proposal.

Proposal 4: Approval of the Plan. Under our Amended and Restated Bylaws, approval of the amended and restated Pegasystems Inc. 2004 Long-Term Incentive Plan requires that the votes cast in favor exceed the votes cast in opposition. If your shares are held in “street name” and you do not instruct your broker how to vote with respect to this item, your broker may not vote your shares with respect to this proposal.

Proposal 5: Approval of the ESPP. The amended and restated Pegasystems Inc. 2006 Employee Stock Purchase Plan will be approved if the votes cast in favor exceed the votes cast in opposition. If your shares are held in “street name” and you do not instruct your broker how to vote with respect to this item, your broker may not vote your shares with respect to this proposal.

Proposal 6: Ratification of the Independent Registered Public Accounting Firm. The ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 20212023 will be approved if the votes cast in favor exceed the votes cast in opposition. If your shares are held in “street name” and you do not instruct your broker how to vote with respect to this item, your broker may vote your shares with respect to this proposal.

How will votes be counted?

Each share of common stock will be counted as one vote according to the instructions contained on a properly completed proxy card, whether submitted by mail, over the Internet, by telephone, or voted online at the Annual Meeting. Shares will not be voted in favor of a matter, and will not be counted as voting on a matter, if they either (1) indicate that the shareholder abstains from voting on a particular matter or (2) are broker non-votes. Banks and brokers that do not receive instructions with respect to Proposals 1, 2, 3, 4, and 35 will not be allowed to vote these shares, which will then be counted as “broker non-votes” instead of votes “for” or “against.”

Abstentions and broker non-votes will have no effect on the outcome of voting with respect to Proposal 2 (Advisory Vote on Executive Compensation), Proposal 3 (Advisory Vote on the Frequency of the Shareholder Advisory Vote on Executive Compensation), Proposal 4 (Approval of the Plan), Proposal 5 (Approval of the ESPP), and Proposal 46 (Ratification of the Independent Registered Public Accounting Firm), because these proposals will be approved if the votes cast at the Annual Meeting in favor of the proposal exceed the votes cast at the Annual Meeting opposing the proposal. Abstentions and broker non-votes, however, will have the effect of negative votes with respect to Proposal 1 (Election of Directors) and Proposal 3 (Shareholder Proposal Regarding Shareholder Proxy Access), because, as described above, each of these proposals requirethis proposal requires the affirmative vote of the holders of shares representing a majority of the votes entitled to be cast at the Annual Meeting by all issued and outstanding shares of common stock on the Record Date.

Who will count the votes?

The votes will be counted, tabulated, and certified by our transfer agent and registrar, Computershare. Matthew J. Cushing, our Vice President, Chief Commercial Officer, General Counsel, and Secretary, will serve as the inspector of elections at the Annual Meeting.

Will my vote be kept confidential?

Yes. Your vote will be kept confidential and we will not disclose your vote unless (1) we are required to do so by law, including in connection with the pursuit or defense of a legal or administrative action or proceeding, or (2) there is a contested election for the Board of Directors. The inspector of elections will forward any written comments that you make on the proxy card to management without providing your name, unless you expressly request disclosure of your identity on your proxy card.

Will any other business be conducted at the Annual Meeting or will other matters be voted on?

No. Under the laws of Massachusetts, where we are incorporated, an item may not be brought before our shareholders at a shareholder meeting unless it appears in the notice of the meeting. Our Amended and Restated Bylaws establish the process for a shareholder to bring a matter before a meeting. See the “How and when may I submit a shareholder proposal for the 20222024 Annual Meeting?” section below.

Where can I find the voting results?

We will report the voting results in a Current Report on Form 8-K, which will be filed with the SEC no later than four business days after the Annual Meeting.

How and when may I submit a shareholder proposal for the 20222024 Annual Meeting?

If you are interested in submitting a proposal for inclusion in the proxy statement for the 20222024 Annual Meeting, you need to follow the procedures outlined in Rule 14a-8 under the Exchange Act and in our Amended and Restated Bylaws. To be eligible for inclusion, we must receive your shareholder proposal intended for inclusion in the proxy statement for the 20222024 Annual Meeting of Shareholders at our principal corporate offices in Cambridge, Massachusetts as set forth below no later than December 30, 2021.29, 2023.

In addition, our Amended and Restated Bylaws require that we be given advance written notice for nominations for election to our Board of Directors and other matters that shareholders wish to present for action at an annual meeting other than those to be included in our proxy statement under Rule 14a-8. The Secretary must receive such notice at the address noted below not less than 120 days or more than 150 days before the first anniversary of the date on which our proxy statement was released to shareholders in connection with the prior year’s meeting. However, if the date of our annual meeting is advanced or delayed by more than 30 days from the anniversary date of the prior year’s meeting (or no proxy statement was delivered to shareholders in connection with the prior year’s meeting), then we must receive such notice at the address noted below not earlier than the 120th day before such annual meeting and not later than the close of business on the later of (1) the 90th day before such annual meeting and (2) the 10th day following the day on which public notice of the meeting date is first made. Assuming that the 20222024 Annual Meeting is held between May 23, 202221, 2024 and July 22, 2022,20, 2024, you would need to give us appropriate notice at the address noted below no earlier than November 30, 202129, 2023 and no later than December 30, 2021.29, 2023. Notwithstanding the foregoing, the postponement or adjournment of any annual meeting for which notice has been provided to shareholders shall not commence a new time period for giving the shareholders’ notice. If a shareholder does not provide timely notice of a nomination or other matter to be presented at the 20222024 Annual Meeting, under Massachusetts law, it may not be brought before our shareholders at a meeting.

In addition, to comply with the universal proxy rules, shareholders who intend to solicit proxies in support of director nominees other than the Company’s nominees must also comply with the additional requirements of Rule 14a-19 under the Securities Exchange Act of 1934, as amended. Our Amended and Restated Bylaws also specify requirements relating to the content of the notice that shareholders must provide to the Secretary for any matter, including a shareholder proposal or nomination for director, to be properly presented at a shareholder meeting. A copy of the full text of our Amended and Restated Bylaws is on file with the SEC.

Any proposals or notices should be sent to:

Pegasystems Inc.

One Rogers

1 Main Street

Cambridge, MA 02142-1209

02142-1517

Attention: Vice President, Chief Commercial Officer, General Counsel, and Secretary

Who will bear the costs of soliciting these proxies?

We will bear the costs of solicitation of proxies. We will request brokers, custodians, and fiduciaries to forward proxy soliciting material to the owners of shares of our common stock they hold in such shareholders’ names. We will reimburse banks and brokers for their reasonable out-of-pocket expenses incurred in connection with the distribution of proxy materials.

How can I obtain an Annual Report on Form 10-K?

Our Annual Report is available in the “Investors” section of our website at www.pega.com, as well as at the following URL: www.envisionreports.com/PEGA. If you would like a paper copy of our Annual Report on Form 10-K, we will send it to you without charge.

Please contact:

Pegasystems Inc.

One Rogers

1 Main Street

Cambridge, MA 02142-1209

02142-1517

Attention: Vice President, Chief Commercial Officer, General Counsel, and Secretary

Telephone: (617) 374-9600

Whom should I contact if I have any questions?

If you have any questions about the Annual Meeting or your ownership of our common stock, please contact Matthew J. Cushing, Vice President, Chief Commercial Officer, General Counsel, and Secretary of Pegasystems Inc. at the address or telephone number listed above.

Householding of Annual Meeting Materials

Some banks, brokers, and other nominee record holders may be participating in the practice of “householding” proxy statements and annual reports. This means that only one copy of our proxy statement and Annual Report may have been sent to multiple shareholders in your household. We will promptly deliver a separate copy of either document to you if you contact us at the address or telephone number listed above.

If you want to receive separate copies of the proxy statement or Annual Report in the future, or if you are receiving multiple copies and would like to receive only one copy per household, you should contact your bank, broker, or other nominee record holder, or you may contact us at the above address or telephone number.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information, which, except as otherwise noted below, is as of January 31, 2021,2023, with respect to the beneficial ownership of our common stock by:

•the shareholders we know to beneficially own more than 5% of our outstanding common stock (based solely on our review of Schedules 13G filed with the SEC);

•each director named in this proxy statement;

•each executive officer named in the Summary Compensation Table included in this proxy statement; and

•all our executive officers and directors as a group.

Unless otherwise indicated, the address of each person listed below is c/o Pegasystems Inc., One Rogers1 Main Street, Cambridge, MA 02142.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| NUMBER OF

SHARES OWNED | | SHARES ACQUIRABLE WITHIN 60 DAYS(1) | | TOTAL SHARES BENEFICIALLY OWNED(2) | | PERCENTAGE OF SHARES BENEFICIALLY OWNED(3) |

| 5% Shareholders | | | | | | | | | |

Alan Trefler (4) | 39,820,517 | | | | 82,772 | | | 39,903,289 | | | | 49.3 | % |

| Bares Capital Management, Inc. | 5,205,967 | | (5) | | — | | | 5,205,967 | | (5) | | 6.4 | % |

| Luxor Capital Group, LP | 3,756,095 | | (6) | | 300,000 | | | 4,056,095 | | (6) | | 5.0 | % |

| Directors | | | | | | | | | |

| Alan Trefler | † | | | † | | † | | | † |

| Peter Gyenes | 30,105 | | | | 7,824 | | | 37,929 | | | | * |

| Ronald Hovsepian | 3,571 | | | | 7,824 | | | 11,395 | | | | * |

Richard Jones (7) | 619,365 | | | | 7,824 | | | 627,189 | | | | * |

| Christopher Lafond | 2,586 | | | | 7,824 | | | 10,410 | | | | * |

| Dianne Ledingham | 9,952 | | | | 7,824 | | | 17,776 | | | | * |

| Sharon Rowlands | 16,011 | | | | 7,824 | | | 23,835 | | | | * |

| Larry Weber | 3,692 | | | | 7,824 | | | 11,516 | | | | * |

| Named Executive Officers | | | | | | | | | |

| Alan Trefler | † | | | † | | † | | | † |

| Kenneth Stillwell | 6,203 | | | | 32,998 | | | 39,201 | | | | * |

| Douglas Kra | 41,164 | | | | 81,210 | | | 122,374 | | | | * |

Hayden Stafford (8) | 3,103 | | | | 14,506 | | | 17,609 | | | | * |

| Leon Trefler | 10,978 | | | | 179,646 | | | 190,624 | | | | * |

All executive officers and directors as a group (9) | 40,579,306 | | | | 531,390 | | | 41,110,696 | | | | 50.5 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| NUMBER OF

SHARES OWNED | | SHARES ACQUIRABLE WITHIN 60 DAYS(1) | | TOTAL SHARES BENEFICIALLY OWNED(2) | | PERCENTAGE OF SHARES BENEFICIALLY OWNED(3) |

| 5% Shareholders | | | | | | | | | |

Alan Trefler(4) | 39,835,195 | | | | 259,351 | | | 40,094,546 | | | | 48.6 | % |

Bares Capital Management, Inc.(5) | 5,550,701 | |

| | — | | | 5,550,701 | |

| | 6.7 | % |

The Vanguard Group(6) | 4,274,667 | |

| | — | | | 4,274,667 | |

| | 5.2 | % |

| Directors | | | | | | | | | |

| Alan Trefler | † | | | † | | † | | | † |

| Peter Gyenes | 8,248 | | | | 16,349 | | | 24,597 | | | | * |

Richard Jones(7) | 604,062 | | | | 16,349 | | | 620,411 | | | | * |

| Christopher Lafond | 5,729 | | | | 16,349 | | | 22,078 | | | | * |

| Dianne Ledingham | 13,095 | | | | 16,349 | | | 29,444 | | | | * |

| Sharon Rowlands | 20,154 | | | | 16,349 | | | 36,503 | | | | * |

| Larry Weber | 6,835 | | | | 16,349 | | | 23,184 | | | | * |

| Named Executive Officers | | | | | | | | | |

| Alan Trefler | † | | | † | | † | | | † |

| Kenneth Stillwell | 15,780 | | | | 103,717 | | | 119,497 | | | | * |

| Rifat Kerim Akgonul | 52,214 | | | | 98,463 | | | 150,677 | | | | * |

| John Gerard Higgins | 2,298 | | | | 36,119 | | | 38,417 | | | | * |

| Leon Trefler | 29,110 | | | | 197,530 | | | 226,640 | | | | * |

All executive officers and directors as a group (8) | 40,594,297 | | | | 820,862 | | | 41,415,159 | | | | 50.2 | % |

* Represents beneficial ownership of less than 1% of our outstanding common stock.

† See 5% Shareholders above.

(1) The number of shares of common stock beneficially owned by each person is determined under the SEC’s rules. Under these rules, a person is deemed to have “beneficial ownership” of any shares over which that person has sole or shared voting or investment power, plus any shares that the person has the right to acquire within 60 days, including through the exercise of stock options or vesting of restricted stock units (“RSUs”). Unless otherwise indicated, for each person named in the table, the number in the “Shares Acquirable within 60 Days” column consists of shares covered by stock options that may be exercised and RSUs that vest within 60 days after January 31, 2021.2023.

(2) To our knowledge, unless otherwise indicated, all the persons listed in the table above have sole voting and investment power with respect to their shares of common stock, except to the extent authority is shared by spouses under applicable law.

(3) The percent ownership is calculated by dividing each person’s total shares beneficially owned by 80,887,71382,453,791 shares, which was the number of shares of our common stock outstanding on January 31, 2021.2023.

(4) As reported in the Schedule 13G, Amendment #20,#22, filed with the SEC on February 12, 202114, 2023 by Mr. Trefler. Includes 27,00070,000 shares of common stock held by the Trefler Foundation, of which Mr. Trefler is a trustee. Mr. Trefler has shared voting and dispositive control over such shares, but has no pecuniary interest with respect to such shares. As of January 31, 2021,2023, includes 998,8002,249,589 shares of common stock pledged or held in margin securities accounts maintained at brokerage firms.

(5) Represents shares of common stock beneficially owned as of December 31, 2020,2022, based on a Schedule 13G, Amendment #3, filed with the SEC on February 16, 202114, 2023 by Bares Capital Management, Inc. (“Bares Capital Management”). Such filing states that Bares Capital Management hasand Brian Bares have shared voting and dispositive power with respect to 5,205,967 shares, and that Brian Bares has sole voting and dispositive power with respect to an additional 1,3195,550,701 shares. In such filing, Bares Capital Management lists its address as 12600 Hill Country Blvd., Suite R-230, Austin, TX 78738.

(6) Represents shares of common stock beneficially owned as of January 27, 2021,December 31, 2022, based on a Schedule 13G filed with the SEC on February 8, 20219, 2023 by Luxor CapitalThe Vanguard Group, LPInc. (“Luxor Capital”The Vanguard Group”). Such filing states that Luxor CapitalThe Vanguard Group has shared voting and dispositive power with respect to 4,056,0954,274,667 shares. In such filing, Luxor CapitalThe Vanguard Group lists its address as 1114 Avenue of the Americas, 28th Floor, New York, New York 10036.100 Vanguard Blvd., Malvern, PA 19355.

(7) Includes 40,59025,790 shares held by the Jones Family Foundation for which Mr. Jones has voting and dispositive power over such shares, but has no pecuniary interest with respect to such shares. Includes 148,719352,691 shares held by the Richard H. Jones Revocable Trust for which Mr. Jones has sole voting and investment power over such shares.shares, of which 282,672 shares of common stock are pledged or held in margin securities accounts maintained at brokerage firms as of January 31, 2023. Includes 13,12414,339 shares held by the Patricia Jones Revocable Trust, 31,065 shares held by the Patricia Jones Irrevocable (Dynasty) Trust and 86,79985,584 shares held by the Patricia Jones Irrevocable Cornerstone Trust for which Mr. Jones’ spouse has sole voting and dispositive power over such shares. As of January 31, 2021, includes 282,672 shares of common stock pledged or held in margin securities accounts maintained at brokerage firms.

(8) Mr. Stafford joined the Company in June 2020.

(9) Includes all 1412 persons who were directors or executive officers of Pegasystems on January 31, 2021.2023.

PROPOSAL 1 – ELECTION OF DIRECTORS

This year our Board of Directors has nominated Peter Gyenes, Richard Jones, Christopher Lafond, Dianne Ledingham, Sharon Rowlands, Alan Trefler, and Larry Weber for election to the Board of Directors. Recently, Mr. Hovsepian was appointed Chief Executive Officer of Indigo Ag. Because of the resulting time commitments of that role, Mr. Hovsepian notified the Company on April 26, 2021 that he could not stand for re-election at the Annual Meeting. Mr. Hovsepian will continue to serve as a member of the Board of Directors and as a member of any committees of the Board of Directors on which he currently serves until the Annual Meeting.

The persons named in the proxy card as proxies will vote to elect each of the nominees, unless you vote against the election of one or more nominees or abstain from voting on the election of one or more nominees, in each case, by affirmatively marking the proxy card to that effect (or through Internet or telephonic voting). Each of our nominees has indicated their willingness to serve, if elected. However, if any of the nominees shall become unable or unwilling to serve, the proxies, unless authority has been withheld as to such nominee, may be voted for the election of a substitute nominee designated by our Board of Directors, or the Board of Directors may reduce the number of directors. Proxies may not be voted for more than seven persons.

There are no family relationships among any of our executive officers or directors, with the exception of Alan Trefler, our Chairman and Chief Executive Officer, whose brother, Leon Trefler, is Senior Vice President, Global Client Success.our Chief of Clients and Markets. Unless otherwise noted, we refer to Alan Trefler as Mr. Trefler and Leon Trefler as Leon Trefler in this proxy statement.

The Board of Directors recommends that you vote FOR the election of the nominees as directors, and proxies solicited by the Board of Directors will be voted in favor thereof unless a shareholder has indicated otherwise on the proxy.

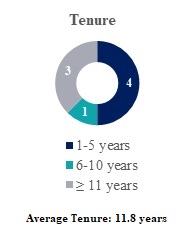

DIRECTOR QUALIFICATIONS

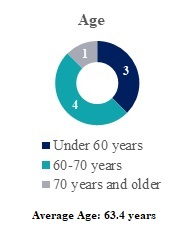

The following information is furnished with respect to each of our directors, as of April 1, 2021.2023. The information presented details the characteristics, qualifications, attributes, and skills that led to the Board of Directors’ conclusion that each of our directors is qualified to serve on the Board of Directors, including significant professional experience and service on the boards of other companies. It includes information each director has given us about their age, all positions they hold with us, and their principal occupation and business experience during at least the past five years, including the names of other publicly-held companies of which they serve, or have served, as a director. Additionally, it is our view that each director exhibits integrity and high ethical standards, as well as sound business judgment and acumen, which are valued and expected characteristics for our directors. Information about the number of shares of common stock beneficially owned by each director, directly and indirectly, appears above under the heading “Security Ownership of Certain Beneficial Owners and Management.” Director Diversity Matrix

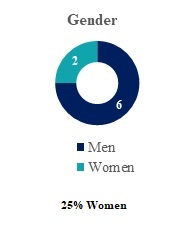

The following Board Diversity Matrix presents information regarding our Board diversity in accordance with Nasdaq Rule 5606, as self-disclosed by our directors. We satisfy the current requirements under Nasdaq Rule 5605(f)(2) by having at least one director who self-identifies as female.

| | | | | | | | |

Board Diversity Matrix (As of April 1, 2022) |

| Total Number of Directors: 7 |

| Female | Male |

| Part I: Gender Identity |

| Directors | 2 | 5 |

| Part II: Demographic Background |

| White | 2 | 5 |

Director Diversity

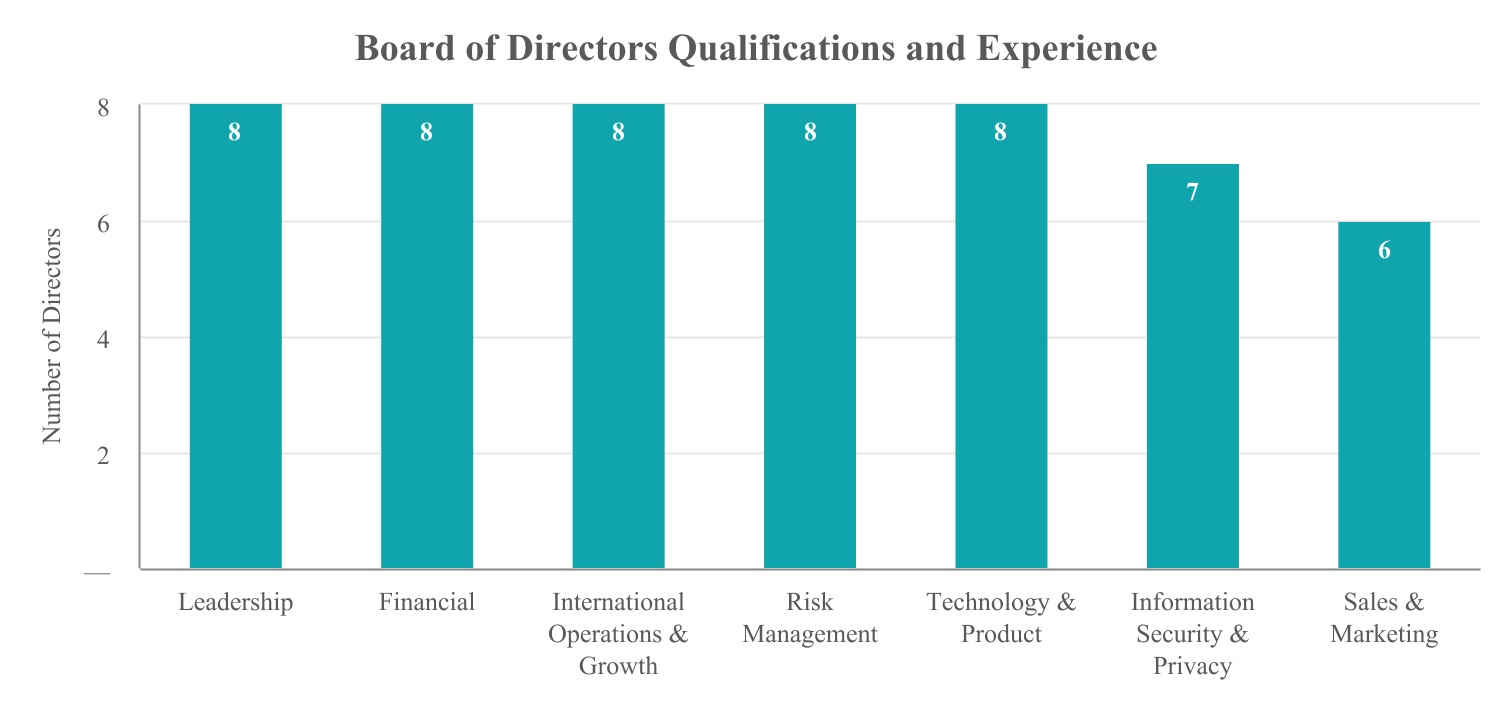

We aim to create and maintain a Board with a diversity of skills and attributes that is aligned with our current and anticipated strategic needs. We value diversity and believe that diversity among our directors’ personal and professional experiences, opinions, perspectives, and backgrounds is desirable. We seek to achieve diversity through our thoughtful selection of qualified candidates. Our candidates, as more fully described below, have experience in, among other areas: leadership, technology, international operations and growth, and sales and marketing.

NOMINEES FOR ELECTION FOR A TERM OF ONE YEAR EXPIRING IN 20222024

•Peter Gyenes, 75, 77, has been a member of our Board of Directors since March 2009. He also serves on our Audit and Nominating and Corporate Governance Committees. Mr. Gyenes has over four decades of experience in global technical, sales, marketing, and general management positions within the software and computer systems industries. Mr. Gyenes serves on the boards of RealPage, Inc., a provider of web-based property management software, and is a Trustee Emeritus of the Massachusetts Technology Leadership Council. Mr. Gyenes previously served on the boards of RealPage, Inc. (until 2021), Sophos plc (until 2020), Information Builders, Inc. (until 2020), Carbonite (until 2019), IntraLinks, Inc. (until 2017), Epicor (until 2016), EnerNOC Inc. (until 2016), Appfluent Technologies (until 2015), and Cimpress NV (until 2015). He served as Chairman and CEO of Ascential Software, as well as of its predecessor companies VMark Software, Ardent Software, and Informix, and led its growth into the data integration market leader from 1996 until it was acquired by IBM in 2005. Previously, Mr. Gyenes served as President and CEO of Racal InterLan, Inc., and in executive positions at Data General Corporation, Encore Computer Corporation, and Prime Computer, Inc. Earlier in his career, he held sales and technical positions at Xerox Data Systems and IBM. He is a graduate of Columbia University where he received both his B.A. in mathematics and his M.B.A. degree. Mr. Gyenes was awarded the 2005 New England Region Ernst & Young Entrepreneur of the Year award in Software. We believe Mr. Gyenes’ qualifications to serve on our Board of Directors include his decades of leadership roles for global technology companies, including his positions as a chief executive officer and director of publicly traded companies, as well as his proven ability to bridge strategy with operational excellence and his experience with mergers and acquisitions.

•Richard Jones, 69,71, joined Pegasystems in October 1999, serving as President and Chief Operating Officer until September 2002. Mr. Jones was a part-time employee of Pegasystems from July 2002 to July 2007. Mr. Jones was elected as a member of our Board of Directors in November 2000, and served as Vice Chairman from September 2002 to July 2007. In July 2011, he was elected a member of our Compensation Committee and of our Nominating and Corporate Governance Committee. Mr. Jones also serves on the Board of Directors of Western Oncolytics LLC aand KaliVir, Inc., both private company which developscompanies developing novel therapies for cancer. From 1995 to 1997, Mr. Jones served as a Chief Asset Management Executive and member of the Operating Committee at Barnett Banks, Inc., which at the time was among the nation’s 25 largest banks. From 1991 to 1995, he served as Chief Executive Officer of Fleet Investment Services, a brokerage and wealth management organization. His prior experience also includes serving as Executive Vice President with Fidelity Investments, an international provider of financial services and investment resources, and as a principal with the consulting firm of Booz, Allen & Hamilton. Since June 1995, Mr. Jones has served as Chairman of Jones Boys Ventures, a retailer. Mr. Jones also serves as a director of Buyers Access, LLC, an OMNIA Partners Company, a purchasing and cost control specialist for the housing market, as well as Colo5, LLC, an independent data center operator, and is currently a Trustee of Episcopal High School Foundation in Jacksonville, Florida. Mr. Jones holds an undergraduate degree from Duke University, with majors in both economics and management science. He also holds an M.B.A. degree from the Wharton School of the University of Pennsylvania. We believe Mr. Jones’ qualifications to serve on our Board of Directors include his two decades of executive management, his financial expertise and business acumen, and his experience gained while serving as Pegasystems’ President and Chief Operating Officer.

•Christopher Lafond, 55,57, has been a member of our Board of Directors since April 2019. In 2020, Mr. Lafond was elected as the Chair of our Audit Committee. Mr. Lafond currently serves as the Chief Executive Officer and member of the board of Insurity, Inc., a role he has held since August 2019. From November 2017 to August 2019, he served as Insurity’s Chief Financial Officer. From June 2015 to June 2017, Mr. Lafond served as the Executive Vice President and Chief Financial Officer of Intralinks Holdings, Inc. From October 1995 to June 2014, Mr. Lafond held a variety of roles at Gartner, Inc., including as Executive Vice President and Chief Financial Officer from 2003 to 2014. Previously at Gartner, he served as Chief Financial Officer for Gartner’s North America and Latin America operations, Group Vice President and North American Controller, Director of Finance, Vice President of Finance and Assistant Controller. From August 2017 to January 2019, Mr. Lafond was a member of the board of Sirius Decisions Inc. Since March 2019, Mr. Lafond has served as a member of the Small Business Advisory Committee of the Financial Accounting Standards Board (“FASB”). Mr. Lafond holds a B.A. in Economics from the University of Connecticut and an M.B.A. degree from the Columbia University Graduate School of Business. Mr. Lafond’s qualifications to serve on our Board of Directors include his extensive leadership experience and financial expertise, including positions such as Chief Financial Officer and member of the board of Insurity, Inc., and as Chief Financial Officer for several companies.

•Dianne Ledingham, 58,60, has been a member of our Board of Directors since September 2016. In January 2017, she was elected a member of the Compensation Committee and the Nominating and Corporate Governance Committee. Ms. Ledingham is a Senior Partner in Bain & Company’s Boston office, a leader in Bain’s Customer Strategy & Marketing practice, and the firm’s Telecom, Media and Technology practice. With her 30-plus year tenure at Bain, Ms. Ledingham is one of the firm’s most prominent leaders in commercial and sales excellence with experience across a range of industries and particular depth in technology and software. In addition, Ms. Ledingham has served on each of Bain’s governance committees including serving on Bain’s Board of Directors, serving on Bain’s Global Compensation and Promotion Committee, including as elected Chair, and serving on Bain’s Global Nominating Committee, as elected Chair. As of September 2022, Ms. Ledingham has been serving on the Board of Directors of Edgio, a technology company optimizing content delivery. Additionally, Ms. Ledingham is currently serving on the board of City Year Boston, and former Chair, as well as Treasurer on the board of Ventures for Hope. Ms. Ledingham holds a degree in electrical engineering with honors from Brown University and an M.B.A. degree with distinction from Harvard Business School. We believe Ms. Ledingham’s qualifications to serve on our Board of Directors include her significant business and marketing experience, including her experience as the founding global leader for Sales and Channel Effectiveness within Bain’s Customer Strategy and Marketing practice.

•Sharon Rowlands, 62,64, has been a member of our Board of Directors since April 2016. In January 2017, she was elected a member of the Nominating and Corporate Governance Committee and as the Chair of our Compensation Committee. Ms. Rowlands formerly served as President (2019-2021) and currently serves as President and Chief Executive Officer of Web.com Group,Newfold Digital, Inc., (formerly Web.com) a marketing solutions company. From November 2017 to January 2019 she served as President of USA Today Network Marketing Solutions at Gannett Co. From 2014 to 2018, Ms. Rowlands served as the Chief Executive Officer and member of the board of ReachLocal, Inc., an Internet-based advertising and marketing company which specialized in search engine marketing, marketing analytics, and display advertising. Ms. Rowlands has more than 20 years of experience serving small to enterprise level businesses in leadership roles. Ms. Rowlands currently serves as an advisor on the board of Sonihull, a company that provides ultrasonic anti-fouling solutions. Ms. Rowlands is also currently serving as a director and the chair of the compensation committee of the board of directors for Everbridge, a public company that develops critical event management software, and The Glimpse Group, a private company developing virtual and augmented reality software and services. From 2011 to 2013, she was the Chief Executive Officer and member of the board of Altegrity, Inc., which provides security and risk management solutions to government and commercial clients. From 2008 to 2011, Ms. Rowlands was the Chief Executive Officer of Penton Media, Inc., a business-to-business information provider producing more than 110 magazines and associated websites, and about 60 industry events. From 1997 to 2008, Ms. Rowlands held a variety of roles including Chief Executive Officer from 2005 to 2008 at Thomson Financial Inc., a provider of market and securities data and other financial services for brokerages, investment bankers, traders, and other investment professionals. From 2015 to 2018, Ms. Rowlands served on the Board of Directors of the Local Search Association, a not-for-profit industry association of media companies and technology providers. From 2010 to 2016, she served on the board of ReachLocal, Inc. From 2010 to 2014, Ms. Rowlands served on the board of Constant Contact, Inc. From 2008 to 2011, she served on the board of Automatic Data Processing, Inc. Ms. Rowlands holds a B.A. in History from the University of Newcastle, Newcastle-Upon-Tyne and a Postgraduate Certificate in Education from Goldsmiths, University of London. We believe Ms. Rowland’s qualifications to serve on our Board of Directors include her extensive leadership experience, including positions as Chief Executive Officer and as a director for several public and private companies.

•Alan Trefler, 65,67, a founder of Pegasystems, has served as Chief Executive Officer and Chairman of the Board of Directors since Pegasystems was organized in 1983. Prior to 1983, he managed an electronic funds transfer product for TMI Systems Corporation, a software and services company. Mr. Trefler holds a B.A. degree in economics and computer science from Dartmouth College. We believe Mr. Trefler’s qualifications to serve on our Board of Directors include his extensive experience in the software industry, including as our founder, Chief Executive Officer, and Chairman of our Board of Directors since our inception in 1983.

•Larry Weber, 65,67, has been a member of our Board of Directors since August 2012. In May 2013, he was elected a member of our Compensation and Nominating and Corporate Governance Committees, and in January 2015, he was elected Chair of our Nominating and Corporate Governance Committee. In June 2021, Mr. Weber was elected a member of our Audit Committee. Mr. Weber has served as the Chief Executive Officer and Chairman of the Board of Racepoint Global, Inc., a digital marketing services ecosystem of marketing service companies organized to help chief marketing officers in their role as builders of communities and content aggregators, since he founded the company in September 2004. From 2017 to 2018, Mr. Weber served on the board as well as the Nominating and Corporate Governance Committee of RMG Networks Holding Corporation, a digital signage provider for most of the Fortune 100 companies. From 2011 to 2013, Mr. Weber also served on the board of Avectra, a provider of web-based association management software (AMS) and social CRM software. In 2001, Mr. Weber founded Weber Shandwick, one of the largest public relations agencies in the world. Mr. Weber is also a co-Founder and Chairman of the Board of the Massachusetts Innovation & Technology Exchange (MITX), one of the largest interactive advocacy organizations in the world. Mr. Weber has authored four books: Marketing to the Social Web: How Digital Customer Communities Build Your Business; Everywhere: Comprehensive Digital Business Strategy for the Social Media Era; Sticks and Stones: How Digital Business Reputations are Built Over Time and Lost in a Click; and The Provocateur: How a New Generation of Leaders are Building Communities, Not Just Companies. Mr. Weber holds a B.A. in English from Denison University, Ohio and a M.F.A. in Writing and Literature from Antioch College, Oxford. We believe Mr. Weber’s qualifications to serve on our Board of Directors include his extensive experience in the global marketing and public relations industry, including positions as founder and Chairman of the Board for Racepoint Global, Inc., and as a director for several companies.

Directors Not Standing for Re-election

•Ronald Hovsepian,60, has been a member of our Board of Directors since January 2019. Mr. Hovsepian has served as a member of our Nominating and Corporate Governance Committee since June 2019 and was elected a member of our Audit Committee in 2020. Mr. Hovsepian currently serves as the Chief Executive Officer of Indigo Ag, an agricultural technology company. Mr. Hovsepian also serves as an Executive Partner at Flagship Pioneering, a private equity and venture capital firm that focuses on healthcare. He was the Chief Executive Officer of Synchronoss Technologies, a telecommunications software and services company, in 2017. From December 2012 to January 2017, Mr. Hovsepian was also Chief Executive Officer of Intralinks. From 2006 to 2011, he served as Chief Executive Officer of Novell. Mr. Hovsepian currently sits on the boards of Skillsoft Corporation, a learning and performance support company; and Ansys Corporation, a simulation software company. From 1998 to 2015, Mr. Hovsepian was Non-Executive Chairman of women’s fashion retailer ANN Inc. From 2015 to 2019, he was also a board member of Cloud Technology Partners. Mr. Hovsepian holds a Bachelor of Science from Boston College. We believe Mr. Hovsepian’s qualifications to serve on our Board of Directors include his significant experience in business and technology companies, including his role as Chief Executive Officer and as a director of several public and private technology companies.

CORPORATE GOVERNANCE

GENERAL

We believe that good corporate governance is important to ensure that Pegasystems is managed for the long-term benefit of its shareholders, and we are committed to maintaining sound corporate governance principles. During the past year, we continued to review our corporate governance policies and practices and to compare them to those suggested by various authorities in corporate governance and the practices of other public companies. We have also continued to review the provisions of the Sarbanes-Oxley Act of 2002, the existing and proposed rules of the SEC, and the listing standards of Nasdaq.

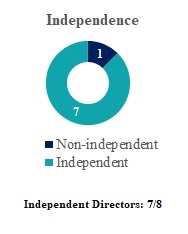

We have adopted policies and procedures that we believe are in the best interests of Pegasystems and our shareholders. In particular, we have the following policies and procedures:

•Declassified Board of Directors. We have a declassified Board of Directors and our Amended and Restated Bylaws provide for one-year terms for our directors. All nominees will stand for election or re-election to one-year terms at this Annual Meeting.

•Majority Voting for Election of Directors. Our Amended and Restated Bylaws provide for a majority voting standard in director elections, so a nominee is elected to the Board of Directors if they receive a majority of the votes entitled to be cast in an election of directors by all issued and outstanding shares of common stock.

•No Hedging Policy. Pursuant to our Insider Trading Policy, we prohibit all hedging transactions or short sales involving Pegasystems securities by our directors and employees, including our executive officers.

The Board of Directors has approved and adopted Corporate Governance Guidelines which provide a framework for corporate governance. These guidelines outline the qualifications required for Board members, the composition and structure of the Board, and the role and responsibilities of the Board. They also detail the various committees of the Board, as well as their structure and purpose. The guidelines address evaluating Board, committee, director and officer performance, establishing executive management talent succession plans, and reviewing pledged or margined shares of the Company’s common stock by executive officers and directors. The Board also implemented stock ownership guidelines for officers and directors. Under these guidelines, our Chief Executive Officer is to own shares equal to three times such person’s annual base salary, directors are to own shares equal to three times such director’s annual cash retainer, and other officers are to own shares equal to one times such person’s annual base salary. Unvested and unearned awards do not count towards satisfaction of the minimum share ownership level. Each director and officer has until 5 years from the later of April 22, 2019 and commencement of services to achieve compliance. Until minimum share ownership is achieved, the applicable director or officer must retain 50 percent of all net shares that vest until minimum share ownership is achieved. In addition, if at the end of the 5-year period a director or officer has not achieved the minimum share ownership level, the director or officer may not sell any shares until the minimum share ownership level is achieved. Currently, each of our directors and officers has eithersatisfied the applicable minimum share ownership level or is within the applicable phase-in period contemplated by the guidelines. In addition to the share retention requirements under our stock ownership guidelines, shares acquired under our Employee Stock Purchase Plan (“ESPP”) may not be sold, pledged or otherwise transferred prior to one year from their acquisition.